Everyone knows that cash is king, but a lot of small and medium business owners do not fully understand the cash in their business. It is not just the money in your bank accounts and your floats. And it is not just the bottom line of your profit and loss statement.

Why is a Balance Sheet Important?

In order to understand the full story of the cash that is in your business you need to learn how to read your balance sheet.

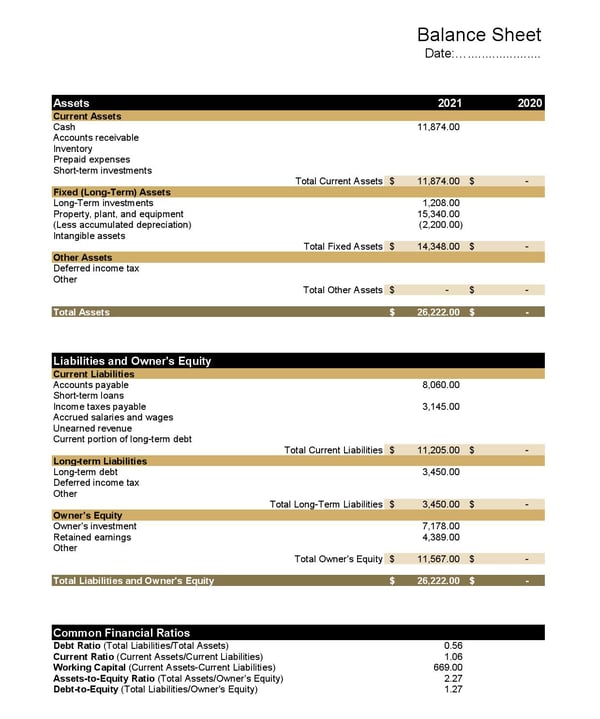

Example of a Balance Sheet:

Understanding your balance sheet can help you determine if you are paying suppliers too quickly or if you are giving customers too much time to pay you. It can help you decide if you are in a position to take on more debt, repay some shareholder loans, reduce your inventory holdings, make an investment in capital equipment and ensure you have enough set aside to pay your taxes.

Cash is More than Cold Hard Money

Cash does not mean what it used to mean.

It is not about holding fistfuls of paper or wheelbarrows of coins. Cash is just a term to describe the accessibility or liquidity of your resources. And operating income is only one source of cash.

We all deal with cash almost every day in our personal lives. Whether we are earning it or spending it, in our personal lives we know we need enough cash on hand to pay our mortgage or rent each month, to cover our bills, to spend on fun things, and to buy presents for our friends and family. And we have all used a balance sheet item, debt, to help with this. Whether running up credit cards at Christmas time and paying them off over a couple months, getting a mortgage for your house or line of credit or loan to buy a car.

Or like I used to do in my early twenties, dragging out payments for phone and utility bills. Which is a form of taking credit from a company without their consent.

At some point in your life, you learn how to handle the cash needs of your personal life, but many people struggle with it in business. It may help to think about your business like your personal life.

What Are the Cash Needs of Your Business?

Your paycheck is like the revenue section of your profit and loss statement. Your groceries, gas, utility bills, fun money, insurance and minor house repairs are the expenses section of your P&L. We know that our take home pay needs to be higher than all these things or we have to start making sacrifices; usually we cut out the fun things first.

The one part of a paycheck that is easier than a business is that your taxes are withheld for you. You never get the opportunity to spend it and dig yourself into a deep hole the way you can with a business. Though, with smart cash management, you can do something similar in your business.

Then you have your mortgage, maybe a car payment, a washing machine that needs replacement, a driveway that needs major repair and retirement savings. These items would all be on a balance sheet in a business. But in our personal lives we still understand that all these items need to be covered from that same paycheck. And, for most of us, that paycheck is not big enough to cover everything at once.

So, we set aside half our mortgage payment from each paycheck. We set up automated savings for our retirement and automatic payments for our car lease. And we either bought a new washing machine on credit, with a credit card or in-store financing, and now we are paying that down plus interest, or we are saving a certain amount from each paycheck until we have enough saved to buy the washer and repair our driveway outright.

But for some reason, in business, these lessons can sometimes get lost.

Many business owners focus largely or even exclusively on the profit and loss statement. And you do need to be conscious of your profit. You can not sustain your business without profits. However there is a lot of important information on the balance sheet that will help you make the most of your business, and ultimately, the time you spend working on your business.

- Do you have enough assets to secure low interest loans when you need them, or do you need to build a cash reserve in your business?

- How much cash could you put into your bank account or reinvest in productive assets if you shortened your receivables cycle? Or if you lengthened your payables cycle?

- Are you tying up money unnecessarily in slow inventory turnover?

- Do you have big deposits paid out that you can follow up on redeeming or are you taking in large deposits and spending the money to clear up debts on previous jobs?

- If something catastrophic happened to temporarily shutter your business and all your current debts were called, what would happen to you?

All these answers are in your balance sheet.

Actionable Accounting Advice

Treating your business cash flow like your personal cash flow can be a great first step down the road to understanding how to use the financial information that is available to you in the most productive way.

Set up multiple bank accounts for your business. You can open free business e-savings accounts at most banks. At the end of every cycle, whether that is a week or a month or by the job, move money to your other accounts to make sure you are setting aside the tax you owe, the reserve you are trying to build, and the debt payments due on the first of the next month. And keep your operating cash, the items that appear on your P&L, in your daily checking account.

Work with people who understand financial statements in depth and make a plan. Determine how you can realistically add productive assets and build reserves. Develop strategies to get paid faster and to lengthen payables without upsetting suppliers. Decide to pay yourself first and make profit a line item in your planning.

Do not let profit simply be what is left over.

Plan for it, leverage the cash that is available inside your company and keep focused on the big picture by becoming proficient with your financial statements. You do not need to get your master’s in business and analyze a hundred different companies, but you should be clear on what you are looking at, and what you can do to improve it, when you set aside your time to review the financial statements with your advisor.

Scott Carrothers is the founder and manager of Foolproof Bookkeeping. He is a Certified Professional Bookkeeper and spent 5 years as the VP of Finance for a medium-sized private corporation. He has extensive experience with entrepreneurship, training, as well as teaching accounting and cost control.